India's smartphone market has seen a massive shift in the past few years. We've not only seen brands put premium phones on a pedestal, but we've also seen buyers embrace the same with open arms, mostly because Indian buyers want to buy more expensive phones. And the latest research suggests it cannot be further from the truth.

India's smartphone market shifts to the premium segment

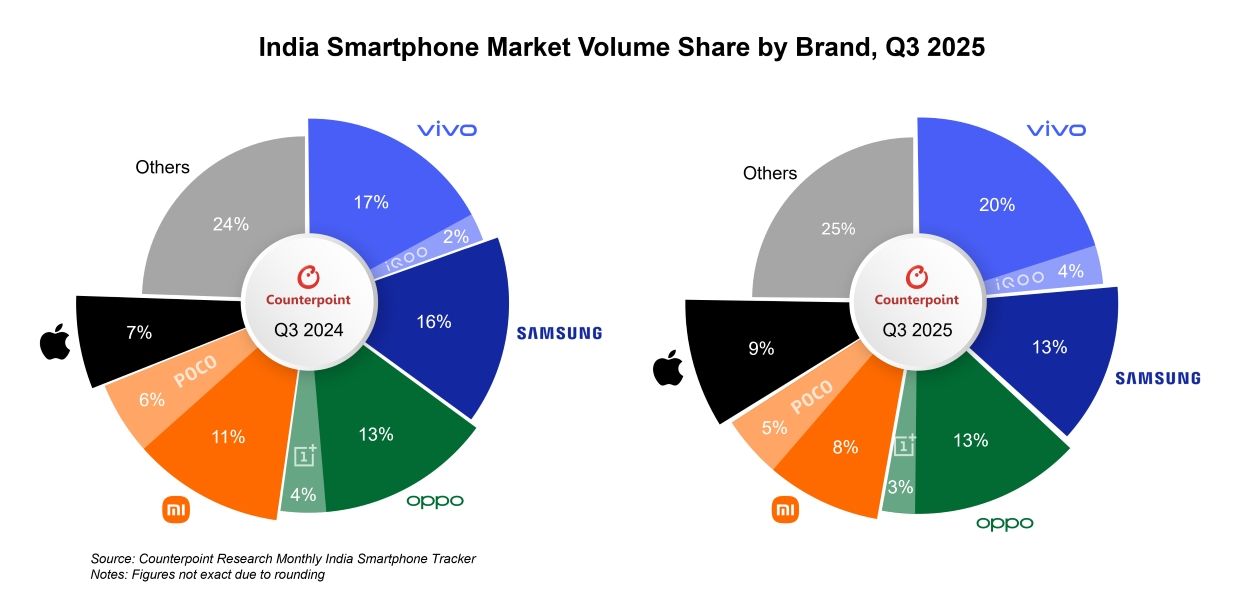

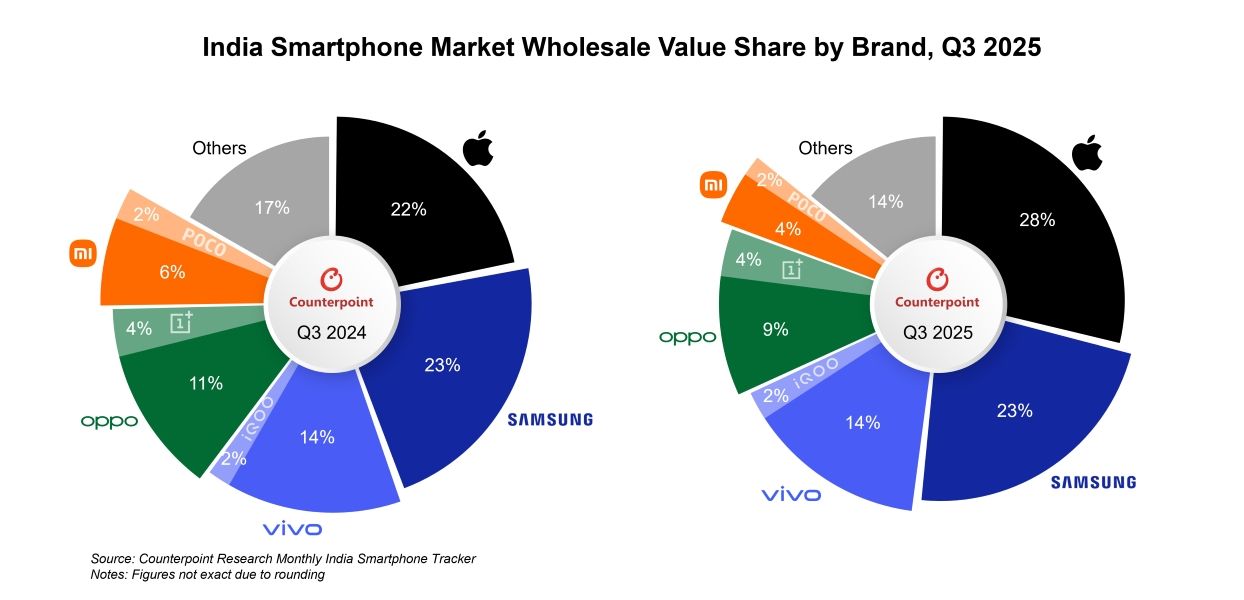

A Q3 2025 research report from Counterpoint Research reveals that while India's smartphone shipment volume grew by a modest 5% year-over-year, the market's total value surged by 18%, hitting its highest-ever quarterly value.

The report states that the spike in value is a direct result of premiumisation as more consumers are moving away from entry-level devices. The average selling price of smartphones in India grew by 13% compared to 2024, and phones costing over Rs 30,000 were the fastest-growing category, jumping 29% YoY.

In layman's terms, more Indian buyers are preferring expensive phones. This is fuelled by frequent and great discounts on premium smartphones, including those from brands like Apple and Samsung.

With the bar for entry set low, thanks to considerable bank discounts and easy monthly instalment options, premium smartphones are more accessible to the public than ever. The credit also goes to the festive season discounts and aggressive trade-in offers.

Apple has been the driving force behind this premiumisation, securing a spot in the top five brands in India by shipment volume. Research suggests this growth was driven by strong demand for the iPhone 16 series, with a notable increase in consumers opting for the more expensive Pro models. The iPhone 17 and iPhone 17 Pro has also seen significant following since its launch.

While Apple captured 28% value share, Samsung followed closely with 23% thanks to its Galaxy S24 and S25 smartphones, mid-range AI phones and record sales of its new foldable devices like the Galaxy Z Fold 7.

Finally, the trend also benefited Chinese players like Vivo and iQOO, which have been doing phenomenally well in the market as of late. Vivo led the mid-range market with an overall 20% share in the shipment volume by focusing on its T series range. Similarly, iQOO emerged as the fastest-growing brand in volume with 54% YoY with its gaming-centric devices and features.

While it will be interesting to see if the trend remains upwards in 2026, the market sentiment has already made it pretty clear that the sub-Rs 30,000 segment is the new "affordable" segment in India. Premium smartphones are now more prominent than ever, while the sub-Rs 20,000 and Rs 15,000 continue to decline.