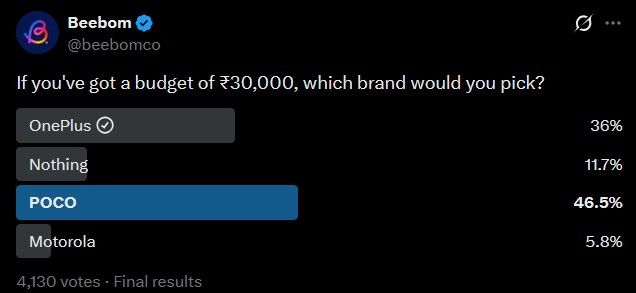

While the ultra-premium smartphone buyers scour to find the perfect balance between specifications and performance, India's mid-range market is still chasing numbers, and for all the good reasons. While brands like OnePlus and Motorola are thriving, offering a blend of clean software, reliable performance and good cameras, the majority of the crowd purely wants performance, and our recent poll's results prove it.

We posted a poll on X asking Indian tech enthusiasts which brands they'd prefer, and while OnePlus was leading for quite some time, Poco soon took over and ended up winning. We also included the likes of Nothing and Motorola, and were pretty surprised at what our readers chose. Here's a full breakdown of the results, a deeper analysis of why users are choosing a certain brand and a brief look at the brands that are trailing far behind.

Poco: The gamer's default

Poco came in first with a whopping vote share of 46.5%. The brand's victory comes as little surprise to those watching the segment closely. The mid-range market in India has become predominantly gamer-centric, with users hyping up frame rates and thermal management over nearly everything else.

The brand has had a checkered history with hardware reliability in the past, often sparking debates about motherboard longevity. But enthusiasts seem to have largely moved past these fears in favour of the price-to-performance ratio.

A huge winning factor for Poco is seemingly its recent Poco F7 offering, which brings Snapdragon 8s Gen 4, a large Silicon Carbon battery and an intriguing design language, making it one of the best smartphones under Rs 30,000.

It's one of the few brands to include a Snapdragon 8 series chipset under Rs 30,000, which offers one of the best gaming performances in the segment. Therefore, for the majority of voters, the equation is simple: High FPS take the game (pun intended).

However, Poco isn't without its drawbacks. Beyond performance, the brand hasn't had the greatest run when it comes to software updates or software itself. While the brand has started offering more years of Android updates, the overall software experience with HyperOS feels like an afterthought.

There's bloatware, updates are slow with most still waiting for HyperOS 3, and the cameras aren't wonderful. Poco smartphones literally carry the script of the original Poco F1, which offered excellent performance but at the cost of everything else. However, the poll results are proof that the script is still working effectively.

OnePlus: The all-rounder for the masses

With a 36% vote share, OnePlus secures a strong second place and proves that, amidst the demand for performance-centric mid-range phones, there's still a huge demand for a no-nonsense daily driver. It didn't lose by a landslide. A 36% share reflects a massive user base that still values the consistent experience OnePlus offers, particularly through its Nord series, and what drove this vote share was the OnePlus Nord 5.

While the Nord 5 did not top the AnTuTu benchmark charts or offer the most aggressive gaming features, the phone won on the usability front. For the average buyer that isn't obsessed with sustained peak performance, OnePlus remains the default recommendation.

The combination of a cleaner software experience, combined with capable main cameras and faster charging, makes OnePlus a better choice under Rs 30,000 for those who need a balanced phone. Although the firm has been through a rough ride with the Green Line fiasco, the bruises still show, with buyers feeling doubtful. Although much of that scepticism has been eradicated with OnePlus offering free lifetime display repairs.

Besides that, there isn't much to complain about OnePlus. Software updates are ultra quick, support longevity has been dialled up to at least four years, just a tad bit short of the bare minimum of Android updates. The phones are no slouch either, with the Nord 5 offering Snapdragon 8s Gen 3 under the hood. However, as the poll shows, in a head-to-head battle with raw speed, balance is currently losing its edge to brute force.

Nothing: Has the cool factor hit a ceiling?

Coming in third, Nothing's 11.7% vote share tells a complicated story. The brand, which built its reputation on making tech "fun" again, has found itself in a weird stage recently. A significant factor that may have contributed to this lower percentage is the brand's controversial decision to introduce Lock Glimpse and Meta Services.

For a brand that marketed itself as the antithesis of bloatware, this did not sit right with the community. Although Nothing quickly announced the removal of these additions, the score seems to be the aftermath of these hasty decisions and the damage was already done.

This stumble also suggests that while users are willing to pay a premium for aesthetics, the phones become a hard sell when the clean software promise shows cracks. Nothing has a lot of work to do to regain that trust. With the Nothing Phone (4a) coming soon, the brand needs to prove it can offer value without compromising the minimalist ethos that put it on the map.

Amidst the RAM crisis, while the series might arrive with a bump in price tag, we learned that the Nothing Phone (4a) will use UFS 3.1 storage. Besides, with five years of updates becoming the bare minimum in mid-range phones, Nothing needs to bump it up to the same to survive the heat of the Indian smartphone market.

Motorola: Clean software matters, but it's not enough alone

Finishing last with 5.8% vote shares is a harsh reality check for Motorola. On paper, the brand should be winning. It consistently offers some of the best hardware value in the segment at aggressive prices that undercut most rivals. However, it finishes last because it's still got the same old "Motorola problem", i.e., software updates.

The software support anxiety is real amongst Motorola users. Most don't want to be in a state of confusion where they constantly have to keep asking for updates that are promised to them. Motorola has some of the cleanest software experiences, but its reputation for slow updates continues to haunt it.

In an era where Samsung and Google are promising up to 7 years of updates, and even Poco, OnePlus and Redmi are improving, Motorola users are often left waiting months for basic security patches. Motorola's situation is also a sobering lesson that hardware innovation has peaked, and software defines whether the phones sell.

The verdict from our readers is pretty clear. Leather finishes with Pantone colours and waterproof ratings are all great, but software experience matters the most. Unfortunately, while Motorola is trying to level up in the number of updates it can promise, the overall software game just hasn't been as strong as its competitors.

In conclusion, the poll results send a loud message that numbers sell in the Indian market, but you will do just as fine if you offer a balanced experience. Poco's dominance and OnePlus' high numbers shine a light on two types of users – performance aficionados and balance finders.

As we move deeper into 2026, the challenge for brands like OnePlus and Nothing isn't just to make good phones, but to convince buyers that a smooth experience is worth more than a high AnTuTu score. But for now? Speed is king.