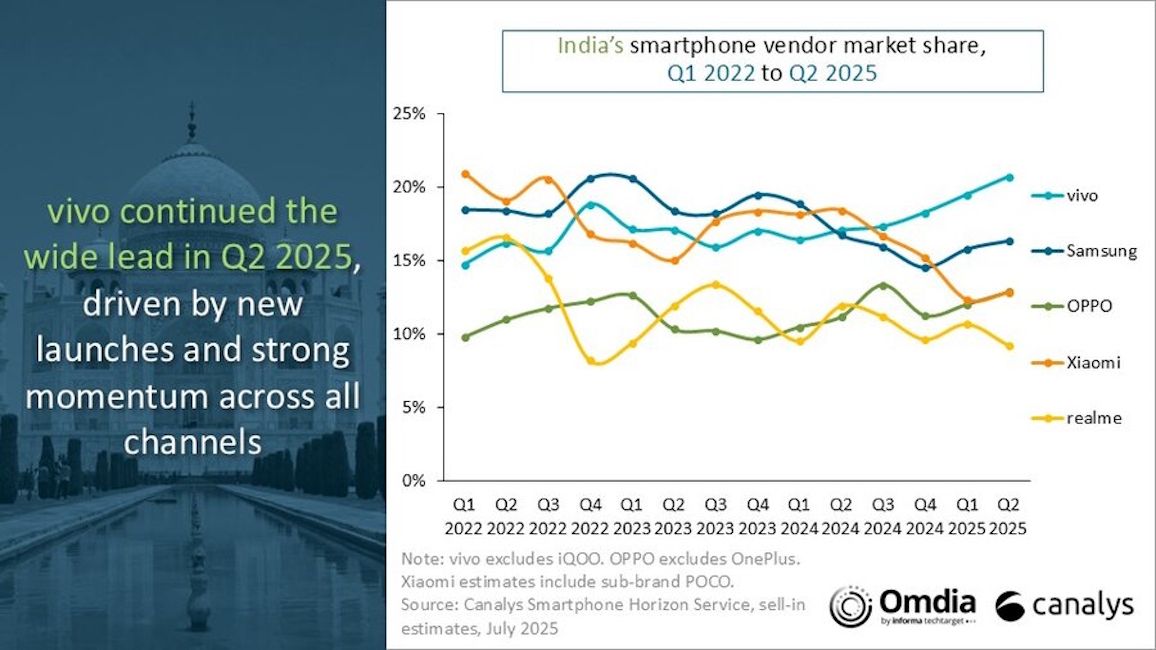

The latest Indian smartphone market reports from Omdia Canalys has given us a good glimpse at how the smartphone market performed in the second half of 2025. It indicates Vivo as the MVP (Most Valuable Player), with brands like Nothing witnessing over 200% growth.

According to Canalys' Q2 2025 report, the Chinese smartphone brand Vivo (excluding its sub-brand iQOO) has managed to ship 8.1 million units, with a 21% market share. These are noteworthy figures considering the economic slowdown and geopolitical tensions that were rife in the subcontinent at that time.

A large part of this can be attributed to the impressive launches from Vivo, including the X200 series, V50 lineup, and the Y300 series. This has also made a significant contribution to the overall Indian smartphone sector, with a 7% year-on-year growth in Q2 2025.

Trailing Vivo, were Samsung, Oppo (excluding OnePlus) and Realme, with 6.2 million units, 5 million and 3.6 million units, respectively.

According to Principal Analyst Sanyam Chaurasia, Vivo's success can be largely attributed to its strategic placement in Tire 1, Tier 2 and Tier 3 cities, with focus on promotion and wider mid-range offerings through channel and distribution partners.

Vivo’s new launches were widely embraced by channels, driven by strong partnerships, while rivals maintained a more measured approach in Q2. The V50 series gained traction in Tier 1 and Tier 2 cities via large-format retail and wedding-led campaigns, while the Y-series sustained momentum in smaller cities and semi-urban markets through deep distribution and promoter push. The T-series also scaled steadily online with a broadened portfolio

— Sanyam Chaurasia, Canalys Principle Analyst

On a similar note, Oppo also managed to take advantage of targeted channel partner distribution for its smartphones, notably the A5 range of devices and the e-commerce platform hero item, the K13, that was an instant hit among its audience.

While Vivo, Samsung, Oppo, Realme and Xiaomi occupied the top five positions, Apple managed to secure the sixth place. 55% of its sales came directly from the iPhone 16 portfolio, excluding the iPhone 16e. Older generation models like iPhone 13 and iPhone 15 were also fan favourites. The only device contributing to the brand's slowdown is the iPhone 16e, which failed to impress the Indian population with the single camera design and an unsavoury price point.

One of the most significant growth was witnessed by London-based tech brand, Nothing, who managed to gain a 229% year-on-year increase, courtesy of the Nothing Phone (3a), Phone (3a) Pro and the CMF Phone 2 Pro.

Apart from this, Motorola managed to increase its retail presence with wider urban areas penetration. Meanwhile, Infinix managed to dethrone Tecno as the more popular Transsion brand, with 1.8 million units shipped. It alone accounted for 45% of Transsion's volume.

With that said, it is safe to note that the Indian smartphone sector saw a significant rise in the global smartphone space. While the first half of 2025 saw multiple smartphone launches, Canalys claims that the second half of 2025 will see brands focus more on offline presence and distribution rather than new launches. Although booming, the subcontinent will still experience a modest slowdown for the full year of 2025.