The latest Indian wearable market report from International Data Corporation (IDC) has given us a good glimpse at how the wearable sector of the country performed in the first six months of 2025. It indicates homegrown brand Boat as the MVP (Most Valuable Player), with a 28% market share and the largest amount of Truly Wireless Earbuds (TWS) shipped.

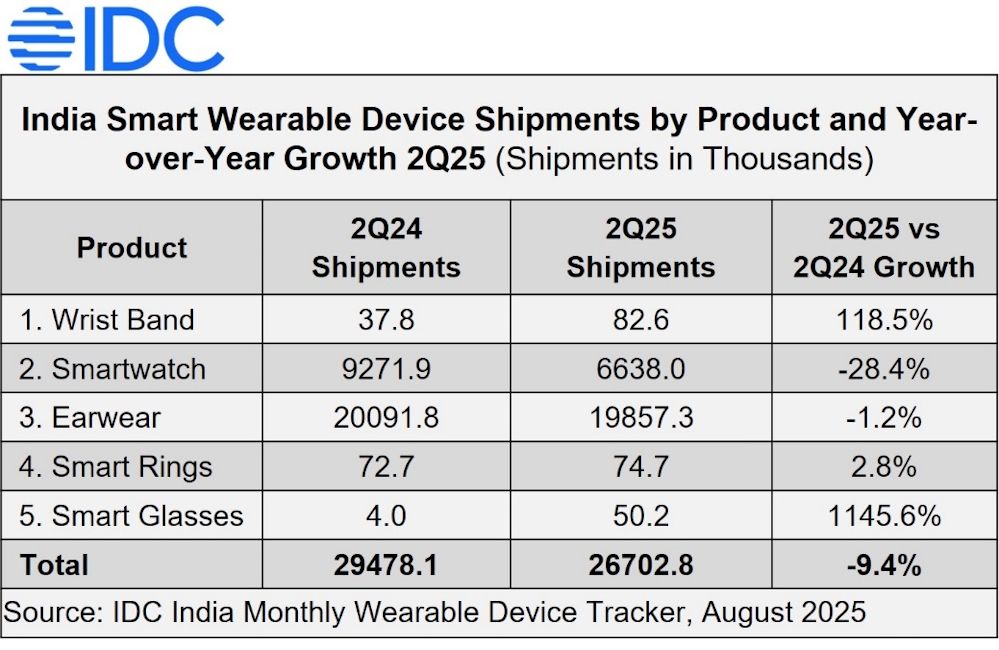

According to IDC’s India Monthly Wearable Device Tracker 2025, India managed to ship an estimated 51.6 million units in the first half of 2025 (H125). However, despite that, the overall wearable market declined by 9.4% in Q2 2025. The overall YoY shipment drop stands at 6.3%.

This made Q2 2025, the fifth consecutive quarter of decline for the wearable market. The only upward trajectory was in the average selling price (ASP) for wearables department with an increase to Rs 1,678.979.

A major contributor to this fall is the smartwatch category that fell by 28.4% YoY with only 6.6 million units shipped in Q2 2025. This led to an overall market share shrinking to 24.9% from 31.5%. A major reason for this downward trend has been attributed to weaker demand for budget smartwatches in the country. This is also indicated by the rise in the average ASP to Rs 1,900.

Along with smartwatches, a notable decline was seen in the TWS and neckband categories as well. Both combined shipped 19.9 million units in Q2. The TWS segment faced a 1.2% YoY decline, although it held 71.2% market share. Neckbands shipment fell drastically with a 16.1% YoY decrease.

The one segment that surged massively is the over-ear headphones department. It saw a sharp 97.4% YoY increase in Q2 2025 with 1.5 million units shipped. This also indicated a clear rise in ASP in the earwear department to Rs 1,522.

Image Credit: IDC

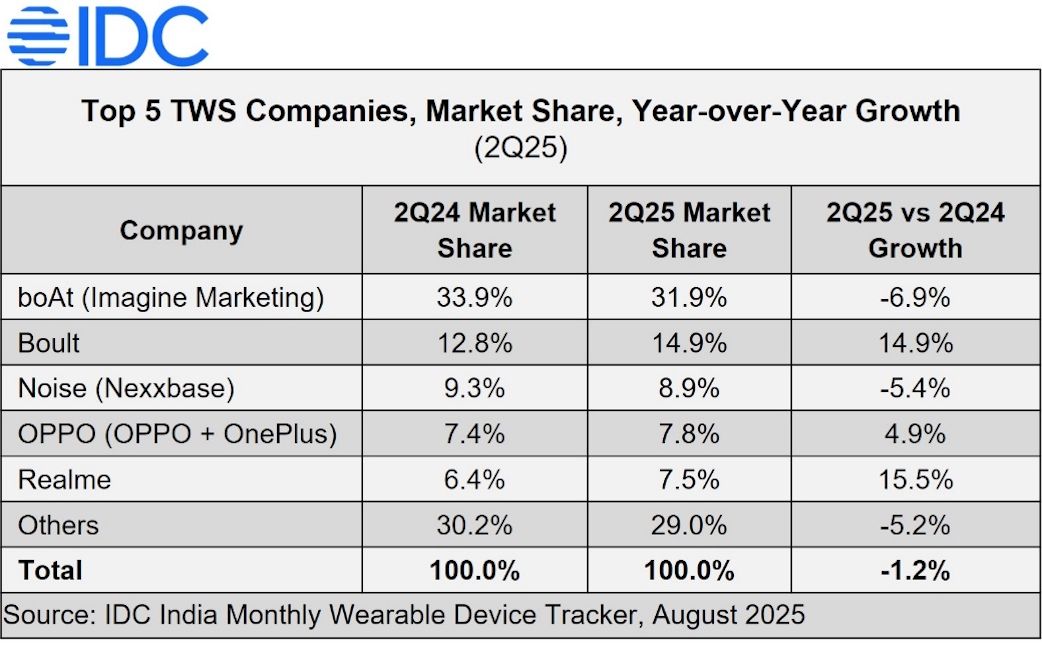

Now, coming to brand performances, the two key players turned up in the form of Noise in the smartwatch department and Boat in the audio wearable category.

Among the two, Boat maintained its leadership position in the Indian wearable market with a commanding 28% YoY share. The brand led with 31.9% and 44.4% market share in the TWS and headphone categories, respectively.

Noise managed to lead with a 30.9% market share, followed by Boat at 13.7%. Xiaomi saw a surge in its units shipped with a 145.5% YoY growth rate.

Speaking on the performance, Amit Khatri, co-founder of Noise, stated that the Indian audience is now more mature than ever, who want consistent value out of their smartwatches. The brand is actively working to innovate more, earn consumer trust and deliver top-notch quality.

The smartwatch market is currently undergoing a recalibration phase with a rise in quality-conscious consumers. In recent years, the category explored unprecedented price points, which spurred a surge in demand. Now, as the market matures, consumers are increasingly gravitating towards brands that offer consistent value. For four years, we’ve not only led the category but expanded our lead, growing our market share even as the industry evolves, staying committed to innovation, quality, and trust. At Noise, we focus on putting the customer first—this isn’t about chasing every spike, but about building long-term trust, delivering real value, and setting the benchmark for what a smartwatch should be. Trust is built through consistency and we’ve established it with every product, witnessing more committed buyers who are upgrading for performance and features. We’re committed to developing products that not only meet today’s needs but also continue to exceed expectations over time.

— Amit Khatri, Co-founder of Noise

With that said, IDC notes that brands are now constantly working to improve sound quality, integrate AI and prioritise cross-device connectivity to bring better value products to the market.