The latest edition of the Indian smartphone market report from International Data Corporation (IDC) has given us a good glimpse at how the smartphone market performed in the third quarter of 2025. It has revealed Vivo as the real MVP (Most Valuable Player), while Apple had its best-performing quarter so far.

Vivo still dominates the Indian smartphone market

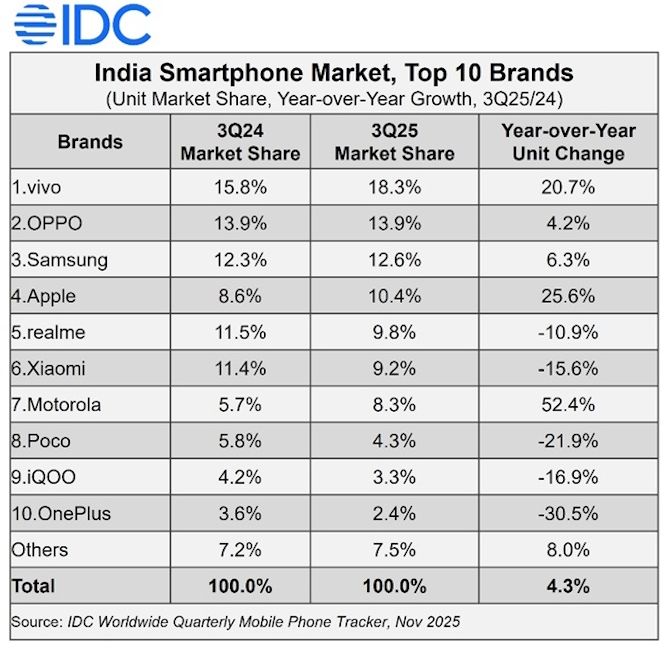

According to IDC’s Worldwide Quarterly Mobile Phone Tracker 2025 report, India managed to ship an estimated 48 million units in the third quarter of 2025 (3Q25). This resulted in a year-on-year turnover of 4.3% and indicated a significant demand during the festive seasons, especially for premium smartphones.

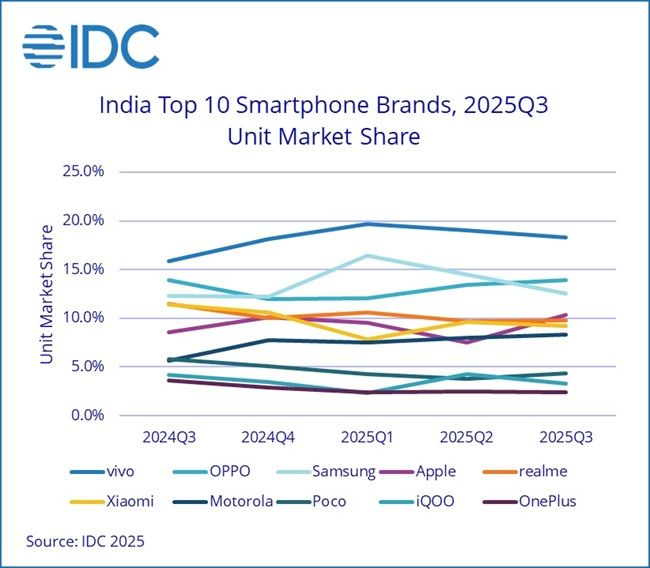

A large part of this can be attributed to Vivo, which managed to hold the top spot for the seventh consecutive quarter and led the pack with an 18.3% market share. This also gave the brand the highest year-on-year turnover at 20.7%. From the compact Vivo X200 FE performance champion to the 200 MP Vivo V60e budget camera star, the brand managed to launch a good smartphone at almost every price bracket.

Now, while Vivo emerged as the most sought-after brand in India, Oppo and Samsung managed to trail behind with 13.9% and 12.6% market shares, respectively. Both brands were successful thanks to their extensive offline presence and a huge selection of budget smartphones, like Oppo with the Reno and F series and Samsung with the Galaxy A, M, and F series.

Aside from the top three brands, it was Apple which had its best-ever quarter in India yet. The brand reached 5 million units shipped with a year-on-year turnover of 25.6%. A large part of this was due to the huge sales volume of the iPhone 16 and the immense popularity of the newly launched iPhone 17. The standard iPhone 17 and the iPhone Air both accounted for 16% of the brand's Q3 shipments.

As per IDC Asia Pacific Senior Research Analyst, Aditya Rampal, the vast majority of India's smartphone market growth can be attributed to not only multiple launches and strong offline presence of the brands but also to the recent festive season in the country.

Growth during India’s festive quarter was driven by a combination of market stimulators, including attractive pricing and deep discounting, flexible payment options, trade-in and upgrade programs, and promotional offers such as cashbacks and bank deals across both online and offline channels.

— Aditya Rampal, IDC Asia Pacific Senior Research Analyst

Aside from how the brands performed, IDC's report also gave a glimpse into the current purchasing power of the Indian population. It noted that the average selling price of smartphones in India saw a rise of 13.7% with the average cost per unit sold rising to approximately Rs 26,100. indicating a strong demand for the "premium mid-range" segment.

However, most of the smartphones sold were of "entry-level" in nature, costing below Rs 8,500. It accounted for 35.3% of the smartphone share in the subcontinent, with brands like Xiaomi, Vivo and Realme leading the segment.

Other than that, the sale of smartphones above the Rs 78,000 mark grew by 52.9%, while devices between the Rs 55,000 and Rs 75,000 range managed to grow by 43.3%.

Consumers also preferred Qualcomm-powered smartphones more than MediaTek-powered ones. As of now, Qualcomm has managed to capture 29.9% of the total market share. MediaTek’s share dropped to 46% in Q3 2025 compared to Q2 2025.

Another interesting observation happened in the point of sale data in India. In the third half of 2025, consumers now prefer to purchase smartphones offline rather than online. Offline shipments rose by 21.8% in Q3 2025 with a 56.4% market share. Online sales, on the other hand, dropped from 51.7% to 43.6%.

That said, IDC notes that the overall smartphone shipments and sales will decline in Q4 2025 due to rising costs in components. The premium segment is gaining momentum in India but the mid-range segment still remains the most competitive arena for smartphone brands.