Global smartphone shipments are projected to shrink in 2026 due to a sharp rise in component costs, the major driving factor being the RAM shortage. The shortage is expected to impact the budgets segment the most, and could drive the prices up by almost 20-30%.

The Average Selling Prices are expected to rise by almost 7%

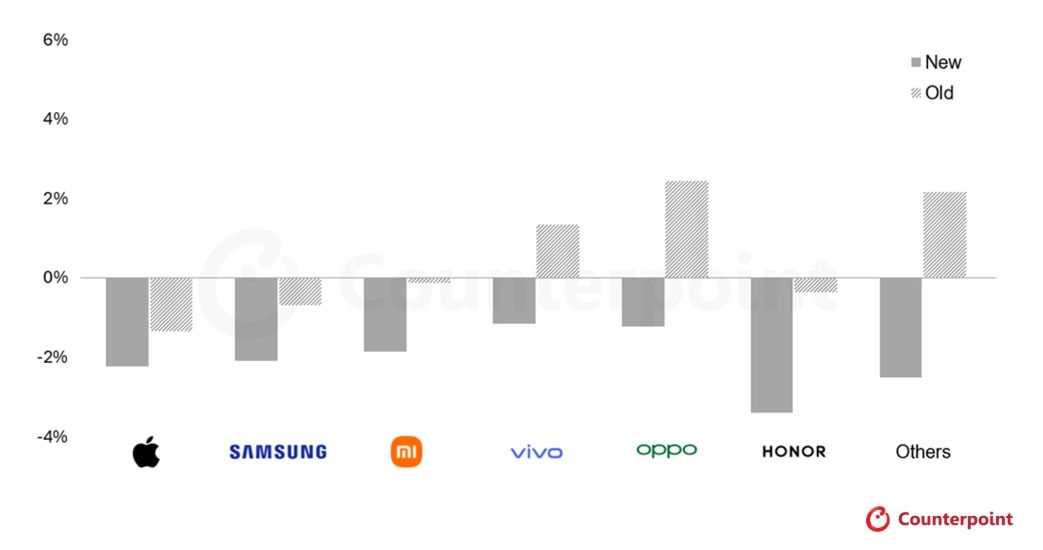

According to Counterpoint Research, global smartphone shipments are expected to see a decline in 2026 as the forecast has been revised downward by 2.6%. Chinese manufacturers like Oppo, Huawei and Vivo are expected to be impacted the most, and will be the ones facing the most adjustments.

Budget smartphones under Rs 30,000 are expected to absorb the aftereffects the most, with the costs skyrocketing by 20% to 30%. However, the pressure is also being felt in mid-range and higher-end smartphones as the prices have already shot up by 10 to 15%. Counterpoint also claims that RAM prices could climb further, potentially adding another 8% to 15% to manufacturing costs.

We already know that in response to these unsustainable cost pressures, manufacturers are increasingly passing expenses on to consumers. The average selling price of smartphones is expected to rise by 6.9%, and OEMs are adopting strategies like streamlining portfolios and reducing volumes of budget phones.

Smartphones will end up costing more despite the downgraded specifications, and brands reusing older components because of the classic supply-demand issue. While giants like Apple and Samsung are better positioned to take this challenge head-on, the overall smartphone prices are still expected to rise, pushing consumers toward more expensive smartphones to offset the rising costs.