Samsung is initiating a massive expansion of its semiconductor manufacturing capabilities where it's aiming to increase DRAM production by nearly 20%. The Korean giant is investing more in its new Pyeongtaek Plant P4 to churn out additional wafers to explicitly target the exploding AI demand.

Samsung will boost its DRAM production capacity

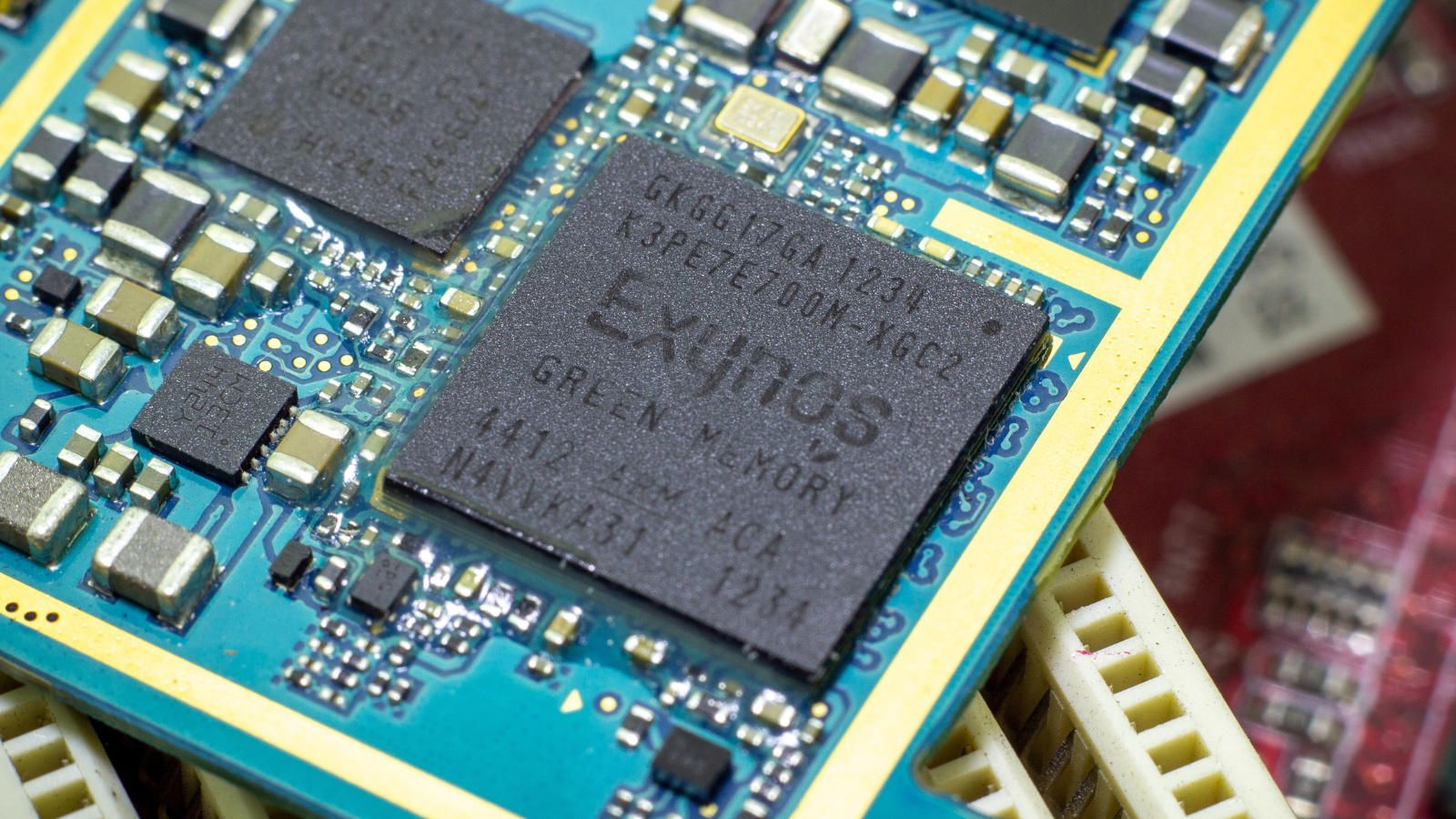

Reported first by the Korean website Hankyung, Samsung is tooling up its Pyeongtaek Plant 4 to increase the manufacturing capacity to 1,20,000 wafers per month, to fuel the demand for AI. The HBM4 (High Bandwidth Memory) focuses on the mass production of 6th-generation 10nm-class (1c) DRAM, which is the core component used in AI servers and accelerators used by NVIDIA and AMD.

This move follows a significant technical turnaround as well, as Samsung has recently redesigned its 1c DRAM architecture to qualify for NVIDIA's strict HBM tests. Industry insiders suggest this 18-20% capacity hike is a response to a super cycle in the memory market, where, with the server DRAM prices already doubled since 2025, Samsung wants to capture the markets before supply chains tighten further.

The company's S5 foundry is also reportedly running at full throttle to produce the base dies needed for these next-generation memory stacks. As for what this could mean for smartphones, it has direct upsides and downsides for smartphone buyers whose buying decisions have been affected by the recent RAM crisis.

For the upsides, Samsung is planning a process transition at its Hwaseong lines to bring the same 1c DRAM to general-purpose mobile memory. For the next generation of smartphones, likely the Galaxy S27 series, this could mean significantly faster RAM that consumes even less power.

However, buyers will hardly see any benefits in terms of pricing. Given the demand, this push will merely keep the RAM available and hopefully won't push the price higher. This could prevent the kind of catastrophic price doubling seen in the server market. Users might have to pay a wee bit more, but they will be paying for faster and more efficient 1c memory.

The Galaxy S26 launch is scheduled for this month, and Samsung's smartphone division is expected to absorb the rising costs of RAM without increasing the price of the smartphones. That said, it's clear that the current RAM shortage is an artificial one, with giants like Samsung and Micron increasingly focusing on HBM memory to maximise profits.