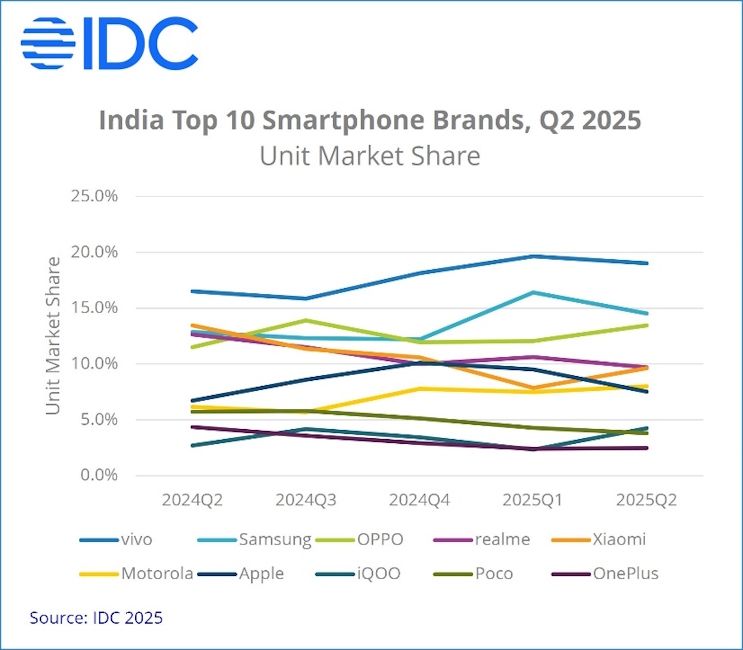

The latest Indian smartphone market reports from International Data Corporation (IDC) has given us a good glimpse at how the smartphone market performed in the first six months of 2025. It indicates Vivo as the MVP (Most Valuable Player), with a 19% market share and a 23.5% YoY unit change.

According to IDC’s Worldwide Quarterly Mobile Phone Tracker 2025 report, India managed to ship an estimated 70 million units in the first half of 2025 (H125). Although the number seems huge, it was a modest year-on-year turnover at 0.9%.

However, actual growth happened in Q2 2025 the YoY shipments grew by 7.3%, with 37 million units shipped. A large part of this progress can be attributed to Vivo. With a 19% market share in 2025, the Chinese smartphone brand managed to emerge at the top for the sixth consecutive quarters.

A large part of Vivo's success can be attributed to its balanced smartphone portfolio. From the Vivo X200 series to the Vivo Y400, the brand has managed to launch a good smartphone at almost every price bracket.

Trailing Vivo, are Samsung, Oppo and Realme, with 14.5%, 13.4% and 9.7% respective market shares. While the Galaxy A, M, and F series smartphones propelled Samsung, Oppo was pushed by affordable offering like the Oppo K13 and Oppo A5x.

Apart from the top three brands, Apple showed a significant growth in 2025, with a YoY turnaround of 21.5%, from 2024. A large part of their sales happened in the form of the iPhone 16, which alone contributed to 4% of all shipments so far.

According to IDC Asia Pacific Senior Research Analyst, Aditya Rampal, the vast majority of India's smartphone market growth can be attributed to multiple launches from brands and a significnt price reduction in older models.

“The second quarter of 2025 witnessed a flurry of new model launches across all price segments. This, coupled with price reductions on older models, increased offline channel margins, and strong above-the-line (ATL) marketing efforts, collectively fueled market growth “

— Aditya Rampal, Senior Research Analyst at IDC Asia Pacific

Apart from brand performances, IDC's report also give us a glimpse into the current purchasing power of the population of India. It says that the average selling price of smartphones in India saw a rise of 10.8% with the average cost per unit sold rising to approximately Rs 24,100.

Most of the smartphones sold were of "entry-level" in nature, costing below Rs 9,000. It accounted for 16% of the smartphone share in the subcontinent, with devices like the Redmi A4 and the Redmi A5 emerging at the top.

Apart from this, the most prominent growth happened in the "mid-premium" and "premium" segments. While the sale of smartphones between the Rs 35,000 and Rs 53,000 mark grew by 39.5%, the sale of devices between the Rs 53,000 and Rs 70,000 price bracket almost doubled, with a 96.4% growth rate.

Another interesting observation happened in the point of sale data in India. In the first half of 2025, consumers preferred to purchase smartphones offline rather than online. Offline shipments rose by 14.3% in 2025 with a 53.6% market share. Online sales, on the other hand, dropped from 49.7% to 46.4%.

Consumers also preferred Qualcomm-powered smartphones more over MediaTek-powered ones. As of now, Qualcomm has managed to capture 33.9% of the total market share. MediaTek’s share dropped to 44.3% in Q1 and Q2 2025. However, MediaTek still leads when we talk about the overall market capture.

With that said, IDC notes that the overall smartphone shipments and sales will decline in the coming months of 2025. This will be largely due to the rise in the Average Selling Price (ASP) of smartphones and several economic challenges.