The Indian smartphone market started 2025 on a high note but faced a chilly end to 2025 with shipments sliding year-on-year in the fourth quarter of the year. A new report suggests a significant decline in the percentage of shipments shipped in Q4 2025, while the overall market also dipped by a marginal percentage.

Vivo takes the crown as the Indian smartphone market slides

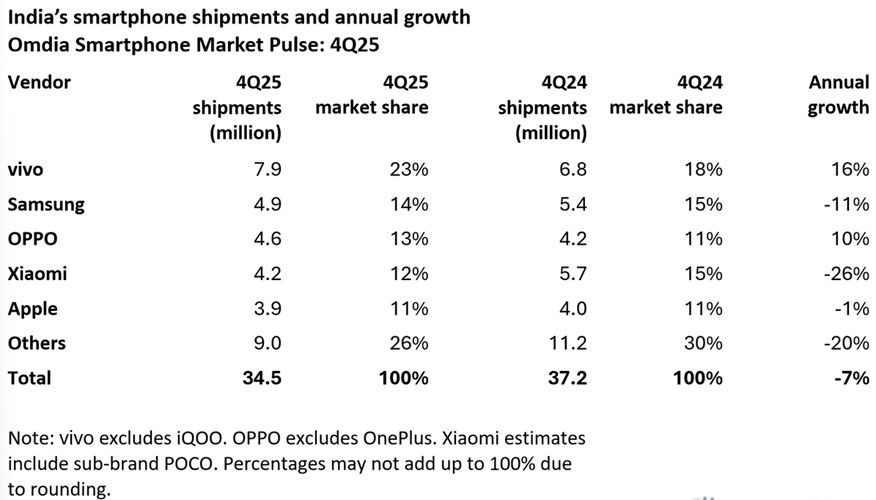

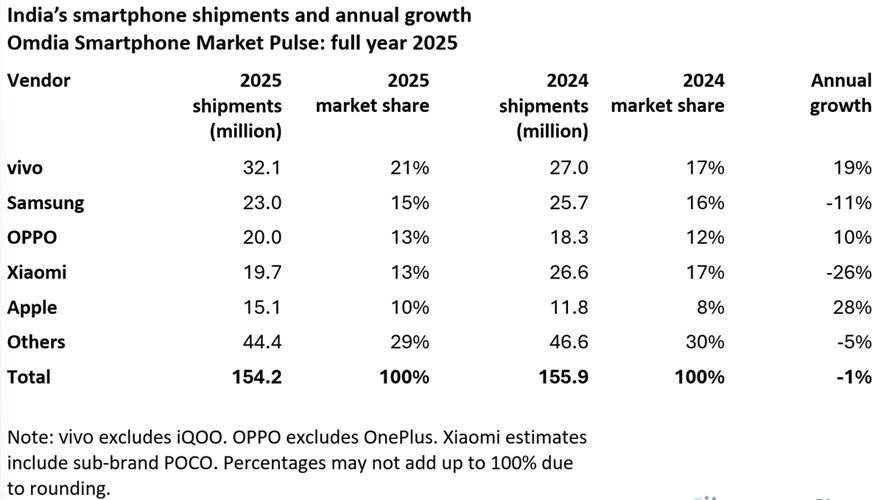

According to a report from Omdia, smartphone shipments in India slipped by around 7% in Q4 2025, settling at 34.5 million units, while the full year closed with a 1% overall decline, with a staggering 154.2 million units shipped. The shipments were led by Vivo, which emerged as the undisputed leader, retaining the top spot.

Vivo was on top for both the final quarter and the full year, with the brand commanding a 23% market share in Q4 alone, shipping a whopping 7.9 million units. According to the report, the success of Vivo phones was driven by a strong retail-first strategy and the popularity of models like the Vivo Y31 5G and the Vivo V60e.

On the other hand, Samsung held onto second place with a considerable 14% market share. The brand shipped 4.9 million units in Q4 2025, but faced a volume decline despite the new foldable and FE launches. The biggest surprise, though, was from Oppo (excluding OnePlus), which overtook Xiaomi to claim third place with 4.6 million units shipped and a 12% share.

Apple, as we all know, had a great 2025 with iPhone 16 becoming India's best-selling smartphone. The brand made it to the top five, albeit at the bottom, with 3.9 million shipments sold. However, Apple is the number one brand in the world, as per the latest Counterpoint research.

As for the reason for the slowdown, Omdia attributes the slowdown to a post festive hungover, combined with economic prices. Besides, it could also be due to the increasing prices of smartphones due to the ongoing RAM crisis.

Omdia highlights that the rising memory prices and depreciating rupee forced brands to increase prices, weakening mass-market affordability. Besides, retailers are already sitting on large amounts of unsold stock and are being cautious about adding new inventory.

As for 2026, the firm notes that India's smartphone market could witness another single-digit decline in 2026. As hardware costs rise, brands are increasingly targeting the best phones under Rs 30,000 and the sub-Rs 60,000 market to protect margins.

They are also relying more on service bundles and trade-in offers to woo cautious buyers. It should be interesting to see how the Indian smartphone market performs in 2026, with brands already preparing to launch smartphones in the coming months. Perhaps a Q1 2026 report will give us a good initial idea, but until then, stay tuned.