The latest Indian smartphone market reports from Counterpoint Research has given us a good glimpse at how the smartphone market performed in the year 2025. It indicates CMF by Nothing as the MVP (Most Valuable Player), with a 83% year-on-year growth, with Nothing emerging as the fastest-growing brand in Q4 2025.

Nothing and CMF posts strong YoY growth in 2025

According to Counterpoint’s Monthly India Smartphone Tracker 2025 report, London-based tech brand Nothing has managed to keep its growth run intact. It has registered 32% YoY growth, making it the fastest-growing OEM in the last quarter of 2025.

What's more impressive is that Nothing's sub-brand CMF managed to record a staggering 83% YoY growth in 2025 with 59% growth in Q4 2025 alone, making it the fastest growing brand in its segment. This comes after Nothing partnered with Optiemus for a $100 million manufacturing joint venture to make CMF an independent brand in India.

A large portion of CMF's growth can be attributed to the CMF Phone 2 Pro, which launched in India way back in April 2025. The report also says that Nothing's Make in India initiative and retail footprint also added to the brand's success. It is opening its first Nothing Flagship Store in Bengaluru this month.

As for the overall market leader, it is still Vivo with a 20% volume share, excluding iQOO phones. The brand has managed to pull off a dual approach with its Y and T series positioned to bring in the most sales and the X lineup as the top-tier offering. Vivo's X series posted 185% YoY growth in 2025. A large part of this success goes to the well-positioned Vivo X200 FE.

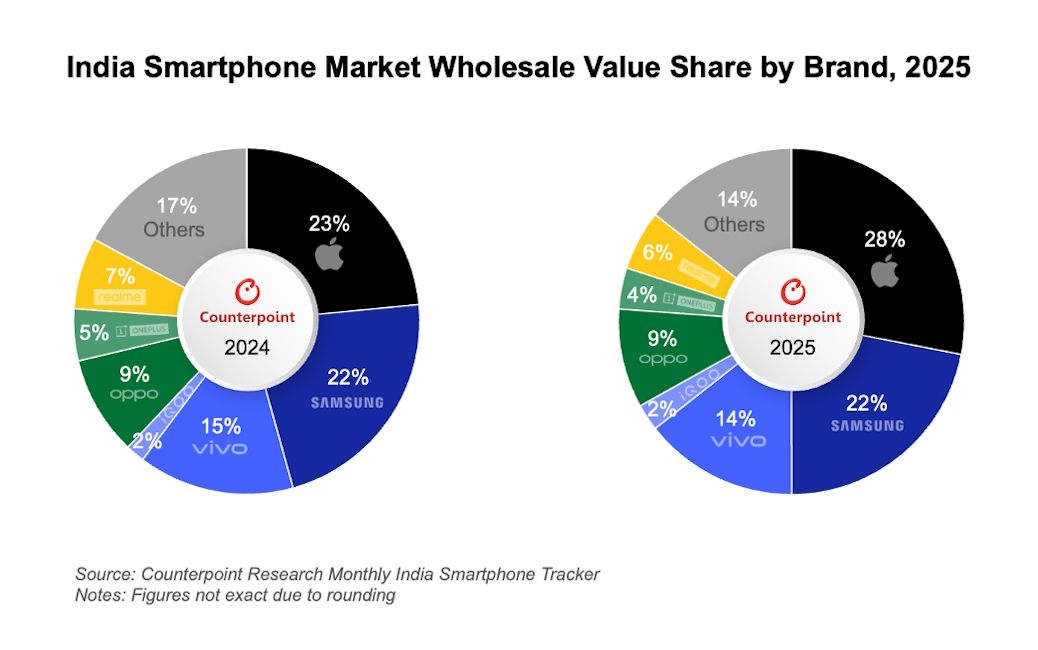

Now, talking about the market trend, the report has revealed that over one in every five smartphones that were sold in 2025 in India was premium. With steady domestic demand, controlled inflation levels and reduced repo rate, brands were able to successfully adjust their portfolio to bring better value in the Rs 30,000 category.

Moreover, with the ease of financing options available in India, more and more consumers were comfortable going for a premium smartphone over budget and mid-range options. The Rs 30,000 segment accounted for 22% of total shipments last year with a 11% YoY growth from 2024.

Moving on, in Q4 2025, smartphone shipments noticeably fell by 4% YoY due to post-festival demand and rising RAM prices. The average smartphone RAM price rose by 5% due rise in AI apps and on-device AI processing. This led to a rise in overall smartphone cost due to higher RAM capacity.

On the semiconductor front, MediaTek managed to lead 2025 with 47% market share. Qualcomm on the other hand, only managed to grab 29% share. Overall, in 2025, India saw a 1% rise in YoY volume with 8% increase in YoY value.

That said, these numbers are set to change in 2026 as Counterpoint predicts that the smartphone market will see a single-digit volume decline due to rising costs. As smartphones become more and more expensive, consumers will prefer to hold off on purchases and rely on their existing phones. The sub Rs 15,000 category is expected to be hit the hardest due to this.