The latest Indian smartphone market reports from Counterpoint has given us a good glimpse at how the smartphone market performed in the second half of 2025. It indicates Nothing as the MVP (Most Valuable Player), with a 37% year-on-year growth in the Rs 45,000 and above price bracket.

According to Counterpoint’s Monthly India Smartphone Tracker 2025 report, London-based tech brand Nothing has managed to keep its growth run intact with a 146% year-on-year shipment increase. This made Q2 2025 the sixth consecutive growth quarter for the brand.

A large portion of this can be attributed to the CMF Phone 2 Pro, which launched in India way back in April 2025. The report claims that the smartphone was well received by the audience and the expansion of the brand's retail footprint also added to the success.

Trailing Nothing are Motorola and Lava, witnessing 86% year-on-year and a 156% increase in Q2 2025, respectively. Lava also became the fastest-growing brand in the subcontinent under the Rs 10,000 price bracket.

Apart from this, the iPhone 16 was the top-shipped smartphone in Q2 2025 and OnePlus saw a 75% year-on-year increase in its ultra-premium segment thanks to the 13 and the 13R. Even Realme entered the premium space with the GT series 7 Pro Dream Edition in Q2 2025.

According to Counterpoint's Senior Research Analyst, Prachir Singh, the Indian smartphone marker was able to see such growth numbers because of improved macroeconomic factors and increased consumer spending power and confidence.

India’s smartphone market recovery in Q2 2025 was further supported by an improved macroeconomic environment that boosted consumer confidence and spending. Retail inflation dropped to a six-year low, easing pressure on household budgets, while the central bank’s repo rate cuts made financing more accessible. Additionally, tax relief measures introduced earlier in the year increased disposable incomes and savings, creating a favourable setup for discretionary purchases

— Prachir Singh, Senior Research Analyst

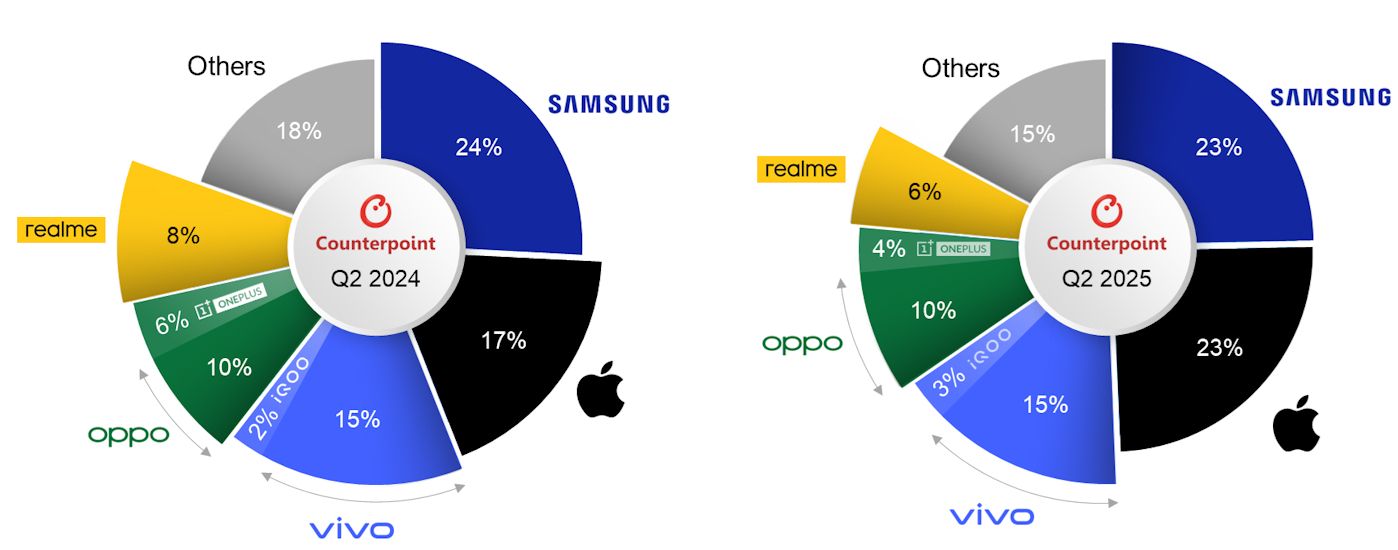

With that said, although Nothing saw the most amount of Q2 2025 growth, it is not the leading smartphone brand in the subcontinent. With a 23% market share respectively, Samsung and Apple are two of the top brands in the subcontinent.

They are followed by Vivo, Oppo and Realme with 15%, 10% (6% Vivo + 4% OnePlus and 6% respectively.

Counterpoint attributes Samsung and Apple's success in the Country to trade-in deals, interest-free EMIs and summer discount campaigns, which both the brands offer with their smartphones.

Apart from this, on the chip-making side of things, MediaTek currently holds the majority Indian market share with 47%, followed by Qualcomm at 31%. The rest 22% market share is distributed among the likes of Unisoc and Samsung.

With that said, it is safe to note that the Indian smartphone sector saw a significant rise in the global smartphone space. Just like the first half of 2025, Counterpoint expects India to maintain its upward trajectory throughout the second half of 2025. This will largely be made possible via premiumization and value-driven smartphone launches in the upcoming months.